Great Investors (and Great Leaders) are Great Probabilistic Thinkers

The unfortunate reality is that nothing is certain, but you have to be (always) right!

“Don’t mistake possibilities for probabilities.”

Ray Dalio

Embracing Uncertainty with a Smile

Ladies and gentlemen, welcome to Students of Leadership.

Today let's talk about something that’s vital for a solid leadership journey: probabilistic thinking. I am here to suggest that the secret sauce behind many great investors (and many great leaders) is their sharp ability for thinking in probabilities – and today I’ll try to have a bit of fun too. After all, life is unpredictable, so it invites us in a way to embrace it with a smile.

What Is Probabilistic Thinking - Why Care?

In simple terms, probabilistic thinking means seeing the world not in black-or-white certainties, but in shades of grey likelihoods. It’s about assessing the odds of various outcomes. “Probabilistic thinking is essentially trying to estimate, using some tools of math and logic, the likelihood of any specific outcome coming to pass. It is one of the best tools we have to improve the accuracy of our decisions” In other words, it’s about treating decisions like bets, weighing the chances and the payoffs.

Why does this matter? Because the world we live in is uncertain and complex. No decision in our life come with guarantees. If you can think probabilistically, you won't panic when plans deviate; instead, you'll adapt, update your odds, and continue forward. Great investors live by this. They know they can be wrong 40% of the time and still win big, as long as their decisions were wise bets. Thinking this way helps navigate complexity with clearer eyes and cooler heads. You just need to make the intellectually honest admission that “anything is possible. It’s the probabilities that matter”

Charlie Munger’s Wisdom: Math, Models, and the One-Legged Man

If you want an example of probabilistic thinking, look no further than Charlie Munger, the famous partner investor (and friend) of Warren Buffett and author of Poor Charlie’s Almanack. Munger is famous for his mental models and no-nonsense wit. He insists on the importance of basic probability in decision-making. In fact, he once warned that “If you don’t get the mathematics of elementary probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest. You’re giving a huge advantage to everybody else.”

Munger’s vivid metaphor always gets a laugh, but his point is deadly serious. Not thinking in probabilities leaves you crippled in competitive environments. you must cultivate “numerical fluency.” You don’t have to be a mathematician (I see some relieved faces out there), but you do need to comfortably weigh odds. Great investors like Munger and Buffett succeed in part because they “automatically think in terms of decision trees and the elementary math of permutations and combinations”.

They ask questions like: What are the odds I'm wrong?

Ray Dalio’s Principles: Don’t Confuse Possibilities with Probabilities

Another legendary investor and author of the book Principles, Ray Dalio, also preaches probabilistic thinking in his own no-nonsense way. In his words, “Anything is possible. It’s the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritized. People who can accurately sort probabilities from possibilities are generally strong at “practical thinking”; they’re the opposite of the “philosopher” types who tend to get lost in clouds of possibilities.”

In other words, just because something could happen doesn’t mean you should base your strategy around it. A good leader must focus on what’s likely to happen and prepares accordingly, without losing sight of less likely risks.

Dalio actually suggests thinking of every decision as a bet. He writes, “Think of every decision as a bet with a probability and a reward for being right and a probability and a penalty for being wrong… with the best decision being the one with the highest expected value.” This is saying we should choose actions that give us the best long-run payoff, after considering their chances of success. Ray Dalio’s approach is very practical for leadership: he literally had his team at his firm assign probabilities to different scenarios and stress-test their thinking. He notes that if you can raise your chances of being right the improvement is huge: “Raising the probability of being right by 34 percentage points means that a third of your bets will switch from losses to wins. That's why it pays to stress-test your thinking, even when you're pretty sure you're right.”

The leadership takeaway? Stay humble and curious. Double-check your assumptions, seek evidence, invite dissenting opinions, and “rigorously prioritize by weighing the value of additional information against the cost of not deciding”.

Great leaders systematically increase the odds of being right.

This is part of their secret

A Real-Life Example: Jeff Bezos Bets Big

Let’s bring this down to earth with a compelling real-life example of probabilistic thinking in leadership. Consider Jeff Bezos who applied probabilistic thinking to strategy. In his 2025 letter to shareholders we find a piece of wisdom to this regard: “Outsized returns come from betting against conventional wisdom, which is usually right. Given a 10% chance of a 100× payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten.”

Think about that for a moment. Bezos is saying that even if an idea has a 90% chance of failing, if the upside is big enough, it’s worth it. Most people run from 90% odds of failure; but a great probabilistic thinker says you should runs toward it, rationally, not recklessly, because the expected value is positive.

In Amazon’s culture, this translated to encouraging experimentation being unafraid of failure. Bezos knew that those few big wins (like AWS and Prime ultimately were) would more than pay for all the projects that didn’t pan out.

This is a lesson of probabilistic thinking in action:

you don’t judge decisions only by outcomes (since even good bets can fail), but by whether the odds and payoff are sound.

If you train yourself in adopting this mindset you won't fear taking calculated risks because you will measure opportunities not just by the chance of success, but by the magnitude of the success if it does happen. This is the secret formula that drives innovation and revolutionize industries.

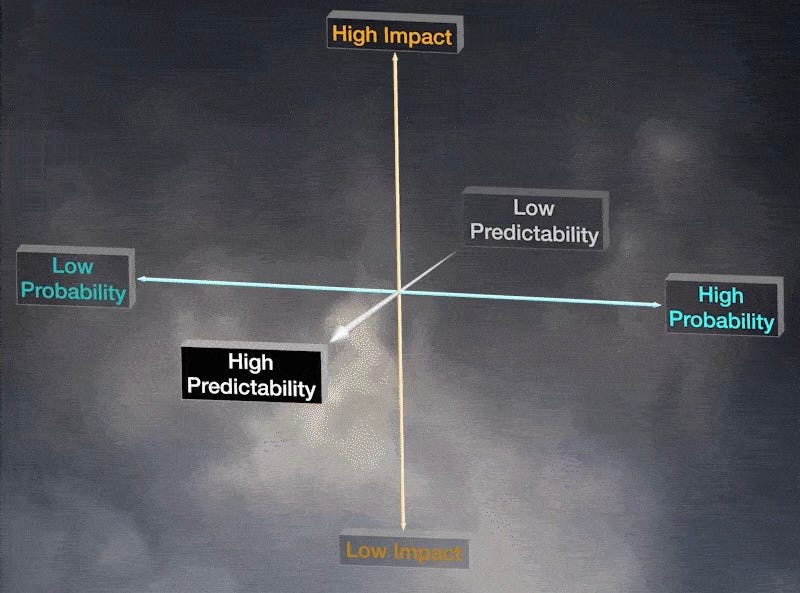

Risk and Uncertainty - Four Dimensional Thinking

How to Think in Probabilities

Frame Decisions as Bets

Whenever you face a major decision, identify the possible outcomes and estimate their probabilities. Ask What’s the expected value? This helps you focus on long-term payoffs and not just short term binary outcomes

Embrace Uncertainty

You will never have perfect information, and that’s okay. Instead of wishing for certainty, equip yourself to navigate uncertainty. Update your probabilities as new information comes in.

Invite Dissent and Diverse Views

Great probabilistic thinkers are often great listeners,“embrace people who think differently” to improve decisions. By hearing out contrary opinions and stress-testing your ideas, you discover flaws in your thinking and improve your odds of being right. Each tough question they pose is new information that helps you refine your probabilities.

Plan for Both Good and Bad Outcomes

Probabilistic thinking isn’t blind optimism, it’s about being realistic. As you pursue a project, ask “What’s our Plan B if outcome X (unlikely but possible) happens?” Smart leaders prepare for a range of outcomes. I don’t like to be caught by surprise or unprepared by a low-probability event, as much as I want to be able to capitalize when a high-upside opportunity comes through.

Conclusion: Tilt the Odds in Your Favor

A leadership challenge is a lot like a poker game, you can’t control the cards you’re dealt, but you can and must control how you play them. Great investors are not fortune-tellers, just astute probabilistic thinkers, they learn how to play the odds with courage and wisdom.

The lesson, learn to be boldly curious and cautiously optimistic. Dare to dream big, just make sure to ground those dreams in analysis and evidence.

So, next time someone says to you that your idea is too risky, you have to simply reply:

“Let’s talk about the odds and the payoff.”

In this context, WISDOM is the ability to use the tools you have to tilt the odds in your favor.

Learn to do it, no excuses.

P.S. Before I go, here you have “The Treat,” where I share some of the music that kept me company while writing … Enjoy as you bid farewell to this post

“Lead yourself, Learn to live. Lead others, Learn to Build.”

If you enjoyed reading this post consider subscribing to the newsletter for free, joining the community and sharing your thoughts.