“Bitcoin is the most efficient system in the history of mankind for channeling energy through time and space.” Michael Saylor

Dear readers,

As you know, I like to reflect on diverse subjects to draw insights into leadership. I study anything that sparks my curiosity and sharpens critical thinking skills. My main premise is that learning how to lead oneself and how to lead others is at the essence of living a life of growth and legacy. This is why we can go from Pizza (first edition, Sep 29th, 2022) to Bitcoin today.

DISCLAIMER: This will be just an introduction to Bitcoin, a highlight of a few important points to help with the understanding of this technology, and how its principles can resonate with leadership excellence in the digital age. This is not an extensive essay. However I want to point something out since the topic today may feel it is not of particular interest to this audience: The challenge I pose to myself and the readers is to expand the sphere of knowledge because it helps with lateral thinking. Wether it is philosophy, food, science, technology, economics, first principles, or Bitcoin, anything that influences and shapes who we are as humans, has a role to play in the refinement of who we can be as leaders.

Now formally, Welcome to another edition of "Sebastian’s Leadership Reflections."

In today's post, we embark on a journey into the world of Bitcoin, learning from the perspectives of Michael Saylor and Saifedean Ammous.

Who are these guys you may ask…?

Michael Saylor is an MIT engineer, long standing founder and CEO of a technology company, who wrote a book in 2012 called “The Mobile Wave” where he predicted how mobile intelligence would be comparable to the agricultural revolution and change everything. He has spent countless hours studying blockchain technology and bitcoin as an asset before publicly talking about it, and even more important he has not just talked but has put serious skin in the game. He has invested both from his personal fortune and his company treasury in bitcoin a total of over 4 billion USD.

Does this mean he cannot be wrong? Of course not, but he represents an in-depth intellectual and investment journey at least worth hearing from. This is not a “cryto” trader trying to convince people of a become-rich-fast scheme, but a serious investor with a long time horizon. In fact he separates clearly Bitcoin from any other “crypto” currency and his only interest is in Bitcoin as a new digital scarce asset class. He has given countless interviews where he explains his journey, from actually an initial skeptic to a firm believer.

Saifedean Ammous is a Lebanese economist that has written probably one of the most respected books in the field, great to understand bitcoin history and its role in the current FIAT monetary system, “The Bitcoin Standard” published in 2018. In this book Ammous analyzes the historical context to the rise of Bitcoin, the sound economic properties that has allowed it to grow quickly, and its probable economic, political, and social implications. He has a particular interest in Austrian economics and free markets, offering a unique perspective on the world. He grew up in Lebanon during its civil war, studied and taught in Lebanon until his departure in 2019 where he teaches at Columbia University, NY. He also hosts a podcast, “The Bitcoin Standard” and has been interviewed multiple times explaining his research and position on the matter.

If you want to stop reading here but remain interested in learning more about bitcoin, I suggest you do your own studies and decide by yourself where you see strengths and weaknesses of this technology and its monetary implications. Is this a new asset class, just a fad or an outright scam

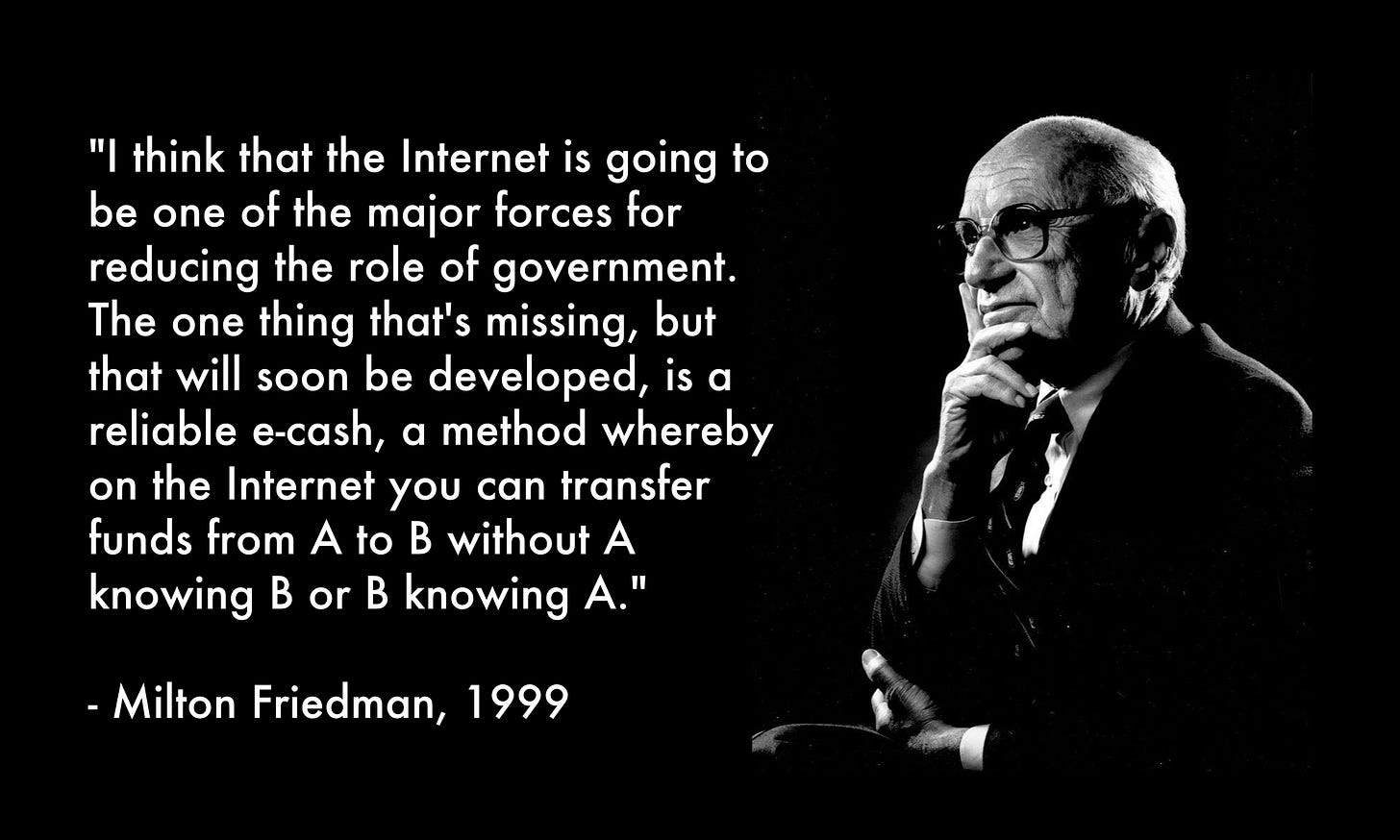

If you decide to continue reading, I first invite you to listen to this clip from a 1999 interview with Milton Friedman, 1976 Nobel Prize in Economics: 1999 - Milton Friedman, "predicting bitcoin” It is just 2 minutes. Listen to what he has to say about the internet and money…

Let’s continue then…

"Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple, & secure savings account to billions of people that don’t have the option or desire to run their own hedge fund." -

Michael Saylor

“While Bitcoin is a new invention of the digital age, the problems it purports to solve — namely, providing a form of money that is under the full command of its owner and likely to hold its value in the long run — are as old as human society itself”.

Saifedean Ammous

Halloween 2008

The birth.

Someone or a group of people under the pseudonym of Satoshi Nakamoto published the 31st of October, 2008 a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System (white paper) This publication represents the Big Bang moment of bitcoin and the birth of blockchain technology

It is an 8 pages document worth reading.

Bitcoin solves the critical problem of “double-spending”, core to the revolutionary value of blockchain technology. If you want to understand it better, in plain language, I recommend going back my previous post The Byzantine's Generals Problem: What Bitcoin teaches us about Leadership in the digital age to better understand what blockchain is.

Understanding Bitcoin: Digital Gold or a Delusion?

Bitcoin is software.

To comprehend the essence of Bitcoin, one must first appreciate it as a meticulously designed piece of software. Bitcoin differs from other digital currencies in that it doesn't operate under the governance of a specific person or entity. Nobody owns bitcoin and everybody that wants to participate owns bitcoin. No individual has the power to alter its underlying protocol, adjust its supply, or manipulate its rules. No CEO presides over its destiny. It's imperative to realize this distinction early on, as it underscores why I focus exclusively on Bitcoin and never talk about “crypto”. I have no interest to venture into the wilderness of cryptocurrencies, as I am only interested in understanding philosophically what problem did Satoshi try to solve? It is a profoundly strategic question to me. I am not an expert, I seek to understand, and I hope you do too.

At its core, Bitcoin is a software protocol, an intricate digital network that empowers individuals to transmit value across the global reach of the internet without the necessity of a middleman. Intriguingly, this software program, Bitcoin, houses an intrinsic currency also known as bitcoin. Therefore, there exists Bitcoin, the network, and bitcoin, the currency. The latter is utilized as a medium of value transfer among users within the Bitcoin network across the internet.

The design of a system that can effectively transmit value, yet requires no foundation of trust, presents an intellectual conundrum. Absence of an intermediary implies that no external entity is verifying the legitimacy of your assets or ensuring the risk of double-spending. Transactions occur directly between users, circumventing intermediaries. This direct exchange is then corroborated by network nodes using cryptographic methods that get time-stamped in a public, distributed ledger, the blockchain.

What factors elevate Bitcoin above traditional currencies? and Why is its existence of consequence in our progressively digitizing world? Saifedean Ammous proposes that the genuine worth of Bitcoin lies in its capacity to revolutionize conventional financial structures, precipitating a paradigm shift in our comprehension and utilization of currency. Bitcoin, often metaphorically referred as 'digital gold', is different from other forms of currency due to its scarcity and decentralized composition. Unlike typical fiat currencies (dollar, euro, etc) issued by nations, Bitcoin's supply is limited by the software at 21 million bitcoins, thereby preventing the temptation of additional “money printing.”

In Ammous's thesis, Bitcoin is more than a mere currency or a store of value. It presents an innovative resolution to the age-old "trust problem" that has historically complicated human economic interactions. By eliminating the need for trusted third parties, Bitcoin paves the path for a new form of digital trust, facilitated by its transparent and unalterable blockchain ledger.

Bitcoin's influence extends beyond the confines of economics, permeating societal structures and political institutions. From the Austrian perspective of economics that Ammous follows, with traditional currencies, central banks and other governing entities dictate monetary policies thus affecting inflation rates, often resulting in economic imbalances and disparities. From this perspective, Bitcoin seems to offer an alternative paradigm, providing individuals with the alternative to reclaim control over their finances. Its properties of being universally accessible, borderless, and resistant to censorship position it as a progressive alternative to traditional banking systems. Time will tell.

In the words of Ammous Bitcoin is not just a revolutionary technology but it creates for the first time “digital scarcity” which provides the basis for the potential of “digital hard money," hence the analogy with gold.

Bitcoin also aims to provide financial inclusivity. Think of the amount of people in this world that are out of the banking system because they do not qualify to even open a simple account, Bitcoin is already breaking with that.

“Globally, 1.7 billion adults remain unbanked, yet two-thirds of them own a mobile phone that could help them access financial services. Digital technology could take advantage of existing cash transactions to bring people into the financial system, the report finds.” (source: World Bank)

Why Bitcoin then?

As Ammous articulates, Bitcoin serves as a testament to human ingenuity, an embodiment of freedom, a catalyst for societal and economic transformation, and financial independence and equality.

As we travel the digital age, Bitcoin emerges for many as the North Star, illuminating this journey towards a more decentralized, transparent, and equitable financial future. Its decentralized model ensures that no single entity has the control over the network, thereby fostering trust among parties without the need of intermediaries.

The concepts of decentralization and trust are the ones that carry profound implications for leadership in the digital era.

Leadership Insights from understanding Bitcoin

- Decentralization and Shared Authority

At the heart of Bitcoin and blockchain technology lies the principle of decentralization - the distribution of authority across the network, rather than being concentrated in a single central point. This egalitarian approach allows for shared ownership, responsibility, and decision-making. Similarly, the contemporary leadership paradigm needs evolving to more collaborative and inclusive frameworks. Acknowledging the value of decentralizing authority in leadership promotes higher levels of teamwork and shared ownership of goals, which can lead to enhanced innovation and productivity within an organization.

- Transparency and Accountability

Blockchain technology is inherently transparent - every transaction is visible to anyone within the network, fostering a high level of accountability. Leadership needs transparency, open communication channels, sharing information freely, and cultivating an environment where every action is made with a sense of responsibility. This helps in building trust, improving team dynamics, and fostering a culture of integrity and honesty.

- Adaptability and Innovation

The rise of Bitcoin, despite skepticism by many and increasing regulatory challenges, underscores the importance of adaptability and resilience. Those who believe in Bitcoin profoundly not only hold what they have but continue to buy into it and work to help increase and strengthen the ecosystem around it. Similarly, today's leaders requires an open mind adapt and understand the implications of rapid change, embrace innovative solutions in the face of evolving frameworks of thinking (just consider the revolution of generative AI), and remain resilient in the face of challenges. Encouraging a culture of continuous learning, experimentation, and adaptation will help organizations stay relevant in this fast-paced digital era.

- Security and Trust

Blockchain technology uses advanced cryptography to secure transactions. In a similar vein, leaders need to build and maintain an environment of trust within their teams ensuring methods of communication that are unique to that particular team (the equivalent to cryptography to blockchain). This includes safeguarding sensitive information, respecting privacy, and being dependable. When teams trust their leaders, they feel psychologically safe, secure, engaged, and motivated to work even harder towards the achievement of common goals. Same as blockchain cannot be corrupted, a strong team culture cannot be broken.

- Inclusivity and Accessibility

Bitcoin's universal accessibility presents a model of financial inclusion that transcends geographical and socioeconomic barriers. Analogously, modern leadership should aim to promote inclusivity and diversity, ensuring that every voice, regardless of its origin, is heard and valued. Leaders who cultivate an inclusive environment can harness a rich array of perspectives, promoting creativity and fostering innovation.

- Long-Term Thinking

Bitcoin's limited supply and the concept of "hodling" (holding Bitcoin for the long term) encourage a focus on the future (if you want you can read my post post on Time Preference, October 14, 2022 ). This correlates with an imperative for leadership excellence, where leaders must think beyond short-term gains and prioritize long-term sustainability and impact. By envisioning a compelling future and aligning actions with a long-term vision, good leaders inspire their teams to persevere, innovate, and create lasting value.

Conclusion

In this brief exploration of Bitcoin we reflect on the transformative power of decentralization, transparency, trust, resilience, disruption, and long-term thinking, when embraced under a compelling leadership vision (in this case, whoever wrote the white paper under the pseudonym of ‘Satoshi Nakamoto’)

Understanding blockchain technology, how it works and its implications in the creation of bitcoin, can provide valuable insights that modern leaders can implement in their leadership approaches to drive their teams towards success in the dynamic, exponential and somewhat unpredictable digital age.

P.S. Before I go, here you have “The Treat,” where I share some of the music that kept me company while writing … Enjoy as you bid farewell to this post. Today is a very long playlist, a medley of piano jazz that you can enjoy as you do other things after reading the article and want to feel more connected to what my early Saturday morning felt like. This post in particular took me a very long time, and for this reason I share a long link

Lead yourself, Learn to live. Lead others, Learn to Build.

If you enjoyed reading this post consider subscribing to the newsletter, joining the community and sharing your thoughts.